An Explanation of Benefits (EOB) is the document that health insurance companies send to communicate their decisions to members regarding payment for services. Every insurance company EOB is different, and many of them are difficult to understand. An EOB is not a bill, but it usually will have enough information for the member to review what the physician will eventually be billing them. Unfortunately, EOB’s are not standardized and can be very confusing to decipher, but it is usually a matter of semantics. Understanding health insurance language is very helpful in reading the communications between your doctor, your insurance company, and yourself.

In the health insurance world, the doctor or hospital is known as the “provider” because they provide services to you, the “member.” Insurance companies group multitudes of people with identical insurance plans into a “group.” The insurance “benefits” are the services that are payable according to the plan you are signed up with. For instance, some plans have maternity benefits, and others do not.

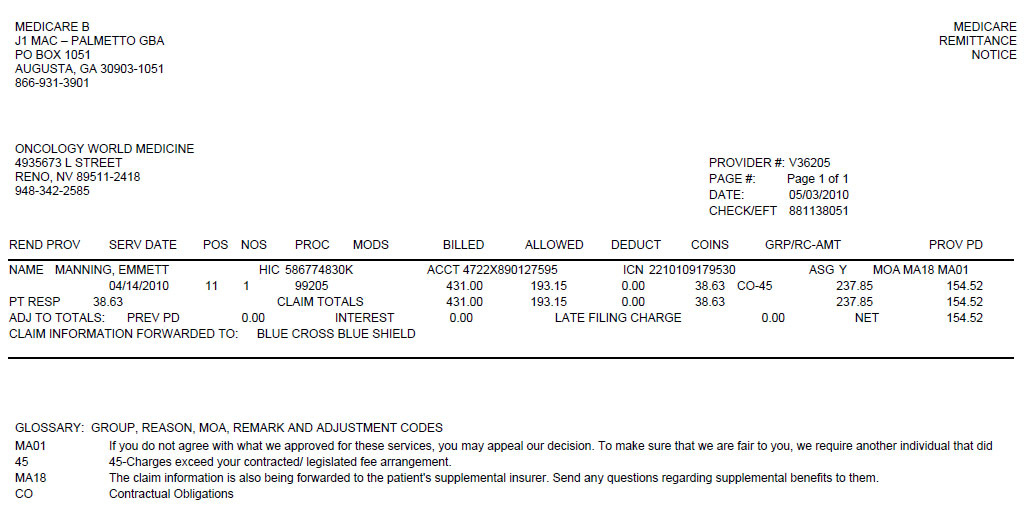

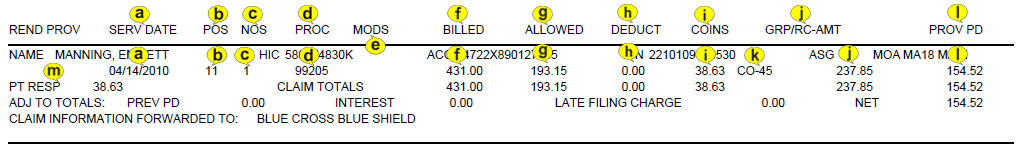

There are many different versions of an EOB. While the information displayed is usually identical, each payer has the option to convey the information in their own format. The most common format style used is the Standard Paper Remittance format. This format is most commonly used by Medicare. An example of that format is displayed below.

This document is cryptic looking and intimidating on first glance. Be assured that it isn’t as complicated as it looks. To make things clearer we are going to examine the most important pieces of the EOB. Let’s take a closer look now at each section.

The header of the document contains three items of note. On the top left ![]() is the name, address and phone number of the insurance company that the EOB is being sent from. Directly below this is the

is the name, address and phone number of the insurance company that the EOB is being sent from. Directly below this is the ![]() name and contact information of the provider where medical services were rendered. On the right hand side,

name and contact information of the provider where medical services were rendered. On the right hand side, ![]()

the date and check number are displayed. This information provides important tracking data.

After the header there are one or more sections of very detailed data. An example of one of these sections is displayed below.

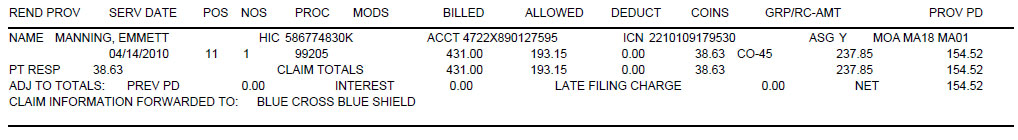

Each one of these sections represents a claim. A claim is made of one or more charges which are usually from a similar date range and which represent treatment for one or a few similar medical diagnosis. Depending on the type of medical treatment you are undergoing, the billing for that medical condition might be comprised of many claims over a period of time. When an EOB is sent to a patient it usually only contains a single claim such as in our example. The claim identifies the member, the individual charges and how or if the insurance company paid each charge. Let’s examine the claim in detail.

At the top of the claim the patient or member is identified. The patient name ![]() is displayed here. There are several numbers appearing on the EOB which all pertain to the provider and insurance company identification and references. The “HIC” number

is displayed here. There are several numbers appearing on the EOB which all pertain to the provider and insurance company identification and references. The “HIC” number ![]() is the member’s personal identification number that the insurance company uses to identify them. The “ACCT” number

is the member’s personal identification number that the insurance company uses to identify them. The “ACCT” number ![]() is a blend of the patient’s account number from the physician’s records and an assigned number from the insurance company. The internal control number or “ICN”

is a blend of the patient’s account number from the physician’s records and an assigned number from the insurance company. The internal control number or “ICN” ![]() is the number assigned by the insurance company that identifies the claim. The ICN will be asked for anytime you communicate with your insurance company about a processed claim. “ASG”

is the number assigned by the insurance company that identifies the claim. The ICN will be asked for anytime you communicate with your insurance company about a processed claim. “ASG” ![]() shows a Y or N, indicating whether or not the provider accepted the assignment of the claim, which includes allowed amounts and acceptance of their decisions and any payments. The Medicare outpatient adjudication remarks codes under “MOA”

shows a Y or N, indicating whether or not the provider accepted the assignment of the claim, which includes allowed amounts and acceptance of their decisions and any payments. The Medicare outpatient adjudication remarks codes under “MOA” ![]() refers to a list that summarizes the decisions made for that particular service. Details about these codes are available at the bottom of the EOB in the glossary.

refers to a list that summarizes the decisions made for that particular service. Details about these codes are available at the bottom of the EOB in the glossary.

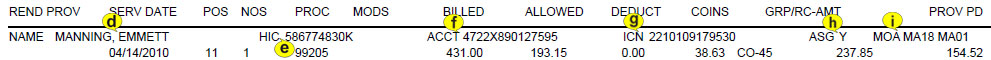

The most important data for a patient to understand on an EOB is pertaining to the services rendered. The headers for each are at the top of the claim. Both the header and the data have been labeled in these examples.

The “service date” ![]() or a range of dates is when the provider claims you received services. In some instances, such as a treatment that requires a great deal of planning, the patient may not necessarily have been present during the rendering of the service, such as in radiation therapy planning. The “POS”

or a range of dates is when the provider claims you received services. In some instances, such as a treatment that requires a great deal of planning, the patient may not necessarily have been present during the rendering of the service, such as in radiation therapy planning. The “POS” ![]() or place of service is the code showing where you received services. For example, this EOB indicates the service was provided in an office/outpatient setting, represented by an ‘11’. The term “NOS”

or place of service is the code showing where you received services. For example, this EOB indicates the service was provided in an office/outpatient setting, represented by an ‘11’. The term “NOS” ![]() is the quantity of times you received each service. This is usually one, but there are times when a procedure is repeated during the same visit. When this occurs, it is billed for the number of times it was rendered. Also, keep in mind that often a service can actually refer to a range of similar treatments. When you visit the doctor, you may receive many different services, such as an office visit and lab work. Each different service is identified by a code and represented by an individual line in the EOB. These codes are referred to as procedure codes and identified in the “PROC”

is the quantity of times you received each service. This is usually one, but there are times when a procedure is repeated during the same visit. When this occurs, it is billed for the number of times it was rendered. Also, keep in mind that often a service can actually refer to a range of similar treatments. When you visit the doctor, you may receive many different services, such as an office visit and lab work. Each different service is identified by a code and represented by an individual line in the EOB. These codes are referred to as procedure codes and identified in the “PROC” ![]() column. These codes are standardized and designed by the American Medical Association. They are used by all physicians to describe the services you received. These numbers have very specific definitions such as “office visit – 30 min. or less” or “Set radiation therapy field.” There may be a modifier labeled as “MODS”

column. These codes are standardized and designed by the American Medical Association. They are used by all physicians to describe the services you received. These numbers have very specific definitions such as “office visit – 30 min. or less” or “Set radiation therapy field.” There may be a modifier labeled as “MODS” ![]() . Modifiers are used to describe an additional detail about how the service was performed or how it is being billed. “BILLED”

. Modifiers are used to describe an additional detail about how the service was performed or how it is being billed. “BILLED” ![]() is the doctor’s charge to the insurance company.

is the doctor’s charge to the insurance company.

If you have received services from a ‘preferred’ or ‘in-network’ provider, that means the doctor has a contract with your insurance company to accept the amount the insurance company is willing to pay for services. The amount the company is willing to pay is known as the “allowed amount”![]() .

.

In this example, the preferred provider who bills $431.00 for a complex office visit is allowed only $193.15 as a payable amount, and therefore would “write off” the remaining $237.85. This is one of the most complicated issues in medical billing. In order to understand it, you need to realize that the provider almost always bills more than is expected to be paid. So, even though $431.00 was billed, the provider is technically only able to bill $193.15. The difference is written off and neither the insurance company nor the patient is expected to be responsible for this amount. The provider must adjust it off. The write off/adjustment process must take place every time the provider sends a bill out. Patient responsibility such as deductibles and co-insurance are calculated from the allowed amount, not the original charge amount. Often, invoices are sent directly to the patient before this process takes place. When the patient receives the original bill before the write off process, the cost can seem overwhelming. That is why it is important that the patient understands the EOB and waits for the write-off process to occur before paying the bill.

Once the allowed amount is determined, the insurance company applies the insurance policy’s patient responsibilities. Many insurance plans have a “deductible,” ![]() or a set amount that the patient is responsible for each year. If your plan has a $200 deductible, then starting January 1st each year, your responsibility of $200 begins again and the insurance company will not pay anything to your physician until you have paid the $200. However, as noted above, the provider’s charges still must be adjusted down based on the policy’s allowed amount. The allowed amount is the only amount the patient can be responsible for. “Coinsurance”

or a set amount that the patient is responsible for each year. If your plan has a $200 deductible, then starting January 1st each year, your responsibility of $200 begins again and the insurance company will not pay anything to your physician until you have paid the $200. However, as noted above, the provider’s charges still must be adjusted down based on the policy’s allowed amount. The allowed amount is the only amount the patient can be responsible for. “Coinsurance” ![]() is a percentage of the allowed amount. This can be a confusing aspect of a patient’s benefits because the insurance company may have different coinsurance percentages on different types of services. For example, laboratory coinsurance can be 20% while an office visit is only 10%. Because of the allowed amounts, the insurance company has to process the physician “claim” or charges before patients will know the actual amounts they are responsible for. Again, it is easy to be deceived by an initial bill received from a provider which was sent before the write-off or adjustment process took place.

is a percentage of the allowed amount. This can be a confusing aspect of a patient’s benefits because the insurance company may have different coinsurance percentages on different types of services. For example, laboratory coinsurance can be 20% while an office visit is only 10%. Because of the allowed amounts, the insurance company has to process the physician “claim” or charges before patients will know the actual amounts they are responsible for. Again, it is easy to be deceived by an initial bill received from a provider which was sent before the write-off or adjustment process took place.

When you see “Disallow” or “RC-AMT” ![]() on an EOB, this is the portion of the billed charge that the insurance company will not pay. This is inclusive of the write-off amount based on the allowed amount

on an EOB, this is the portion of the billed charge that the insurance company will not pay. This is inclusive of the write-off amount based on the allowed amount ![]() . This can simply be the write-off as per the contract between the insurance company and the physician, or it can be a full denial of the services being billed. Either way, there will be a “denial code” somewhere on that line being billed. The write off or denial code will be short, such as in this case, CO-45

. This can simply be the write-off as per the contract between the insurance company and the physician, or it can be a full denial of the services being billed. Either way, there will be a “denial code” somewhere on that line being billed. The write off or denial code will be short, such as in this case, CO-45 ![]() . This code stands for Contractual Obligations, meaning that this amount was written off, or adjusted based on the contract agreement with the provider.

. This code stands for Contractual Obligations, meaning that this amount was written off, or adjusted based on the contract agreement with the provider.

The next item of interest is the “PROV PD” ![]() or more succinctly, the amount the insurance company paid. In this case, the insurance company paid $154.52. Remember this is based on the allowed amount of $193.15. That implies that only $38.63 is outstanding. Notice that the amount $38.63 is referenced next to the title “PT RESP”

or more succinctly, the amount the insurance company paid. In this case, the insurance company paid $154.52. Remember this is based on the allowed amount of $193.15. That implies that only $38.63 is outstanding. Notice that the amount $38.63 is referenced next to the title “PT RESP” ![]() . This stands for Patient Responsibility or the amount that the patient must pay the provider. If you have secondary insurance, make sure you have given all of your information to your physician, because the next bill to go out will be to that insurance company. Generally, a secondary insurance company will only pay the amount the patient is responsible for. An EOB from a secondary insurance company will show if the patient has any responsibility to the physician.

. This stands for Patient Responsibility or the amount that the patient must pay the provider. If you have secondary insurance, make sure you have given all of your information to your physician, because the next bill to go out will be to that insurance company. Generally, a secondary insurance company will only pay the amount the patient is responsible for. An EOB from a secondary insurance company will show if the patient has any responsibility to the physician.

This summarizes the most important aspects of the claim section of the EOB. The rest of the data fields shown represent the totals of the claim. There are also some fields that allow for when unusual circumstances occur such as interest payments. There is one more important area on the EOB. The “GLOSSARY” reference at the bottom of the EOB will give a short explanation of each code referenced in the EOB.

After the primary insurance and secondary insurance have processed the claims, finally, the physician will send a bill for any leftover patient responsibility to the patient. Some offices collect co-pays at the time of the visit because that amount is always due and can be counted upon as correct. Always read the communications from your insurance company and compare the dates, billed amounts, and patient responsibility amounts to your physician’s invoice.

Again, a patient who has insurance needs to make sure they wait until their insurer has processed the charges before they pay their portion. Patients may receive the initial unprocessed charges that show the provider has billed the insurance, and it may appear that the patient owes the amount being billed. It is important to understand that the provider is charging more than they expect to be paid, and the insurance company will likely reduce that amount again before applying patient responsibility.

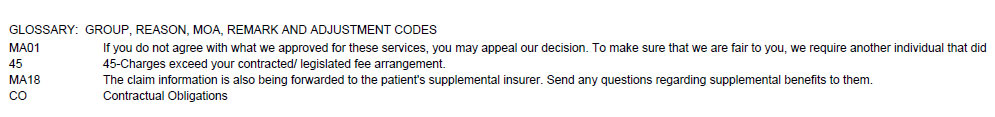

Wait for an EOB from your insurance company before paying for services that appear on your physician’s invoice. If you have more than one insurance company, wait for all EOB’s showing each determination. Remember, the “billed amount” minus the “adjustment” or write-off equals “allowed amount.” Patient responsibilities are based on this “allowed amount” and subtracted from it before the physician gets a payment. The physician will bill the amount marked “Patient Responsibility” on the EOB. All this information should be conveyed in the patient bill. Let’s look how this would appear based on the example EOB above.

Here, you can see how it all breaks down. In this example, the initial billed amount ![]() is $431.00. Next, $237.85

is $431.00. Next, $237.85 ![]() represents primary payer’s (MEDICARE), disallowed amount, which was adjusted off the account by the provider. The primary payer also made a payment

represents primary payer’s (MEDICARE), disallowed amount, which was adjusted off the account by the provider. The primary payer also made a payment ![]() of $154.52. This corresponds exactly to the original EOB we looked at above. Next, it is shown that the secondary payer

of $154.52. This corresponds exactly to the original EOB we looked at above. Next, it is shown that the secondary payer ![]() also made a payment of $28.63. Finally, that all adds up to a remaining patient responsibility

also made a payment of $28.63. Finally, that all adds up to a remaining patient responsibility ![]() of $10.00. This is the amount billed to the patient.

of $10.00. This is the amount billed to the patient.

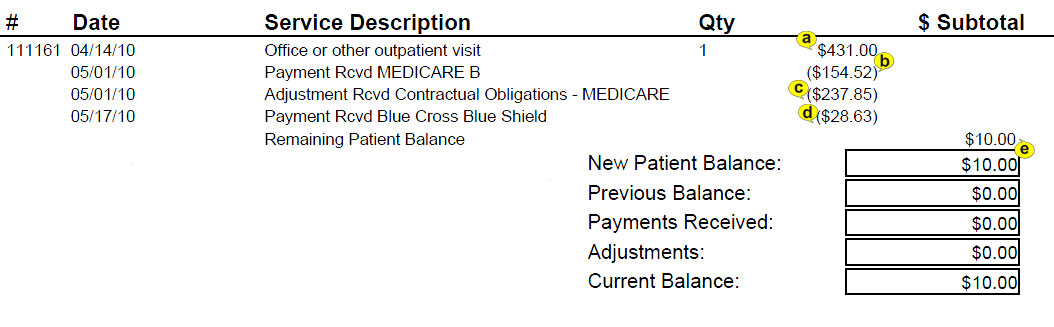

In some cases, physicians will set up a payment plan with their patients in the case of ongoing therapies or lengthy illness. The monthly bill should reflect this agreed upon amount due in a ‘Minimum Amount Due’ category, even if the total balance is larger. This is shown in the example below. You can see that while the current account balance ![]() is very large, the minimum payment

is very large, the minimum payment ![]() required reflects the fact this patient is on a $100.00 a month payment plan.

required reflects the fact this patient is on a $100.00 a month payment plan.

If you ever have questions or suspect any errors in your patient bill, don’t hesitate to ask for assistance. As you can tell, this is a complex process and miscommunication is common. Consider calling both your insurance company and physician to verify that the explanations are in sync. Always take notes, and if possible, retrieve a case number for these calls in case you need to dispute a bill. Communication with all parties is important for your understanding, and if you find a mistake, it is always correctible.