I spoke to a friend a few days after her 62nd birthday, and we joked about “only 3 more years to go to get the red, white and blue card.” Some may consider turning 65 a “milestone” birthday for other reasons, but for a number of folks it ushers in the “Medicare” coverage years.

As people are living longer and as trying to survive on social security income alone is harder, more and more of those 65+ y ear olds and/or their spouses continue to work. For some, they even qualify for employer health plans. As a medical office biller we must be intimately aware of the circumstances that will designate a patient’s Medicare Part B coverage as primary or secondary responsibility.

ear olds and/or their spouses continue to work. For some, they even qualify for employer health plans. As a medical office biller we must be intimately aware of the circumstances that will designate a patient’s Medicare Part B coverage as primary or secondary responsibility.

CMS.gov has an extensive library of educational materials that specifically detail how the Medicare Part B coverage is determined to be primary or secondary for these 65+ beneficiaries. Simply search for “MSP” on their website to access this wealth of knowledge.

Even with this information readily available, I am often asked about claim rejections for patients with Medicare Part B as their secondary payer. With that in mind, I want to shed a little light on why these rejections happen, so you can avoid them in your office.

A patient can have Medicare as a secondary payer under several circumstances:

1. Black lung

2. Disabled beneficiary under age 65 with large group health plan

3. End-stage renal disease beneficiary in the 12 month coordination period with an employer’s group health plan

4. Public health service or other federal agency

5. Veteran’s administration

6. Worker’s compensation

7. Working aged beneficiary or spouse with employer group health plan

8. No-fault insurance, including auto is primary

9. Other liability insurance is primary

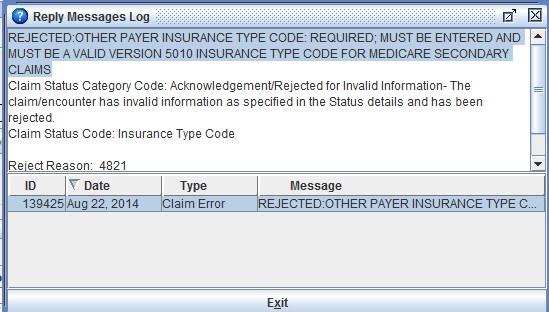

When your 837 electronic claims are created and transmitted out of your system, the secondary payer information is included on both the primary and secondary claims. You need to indicate the type of Medicare secondary coverage the patient has from the above list. If the data on the claim does not match exactly the patient record at their primary payer, you will receive a rejection of that electronic claim. Medicare will also reject a claim they receive as secondary payer if the wrong type is not on the claim.

The picture below indicates a sample message that could be received when inaccurate Medicare secondary data is included on the primary claim.

How do you k now which one to pick? In the CMS documentation, there are examples of questions office staff can utilize when interviewing the patient in order to determine their coverage type.

now which one to pick? In the CMS documentation, there are examples of questions office staff can utilize when interviewing the patient in order to determine their coverage type.

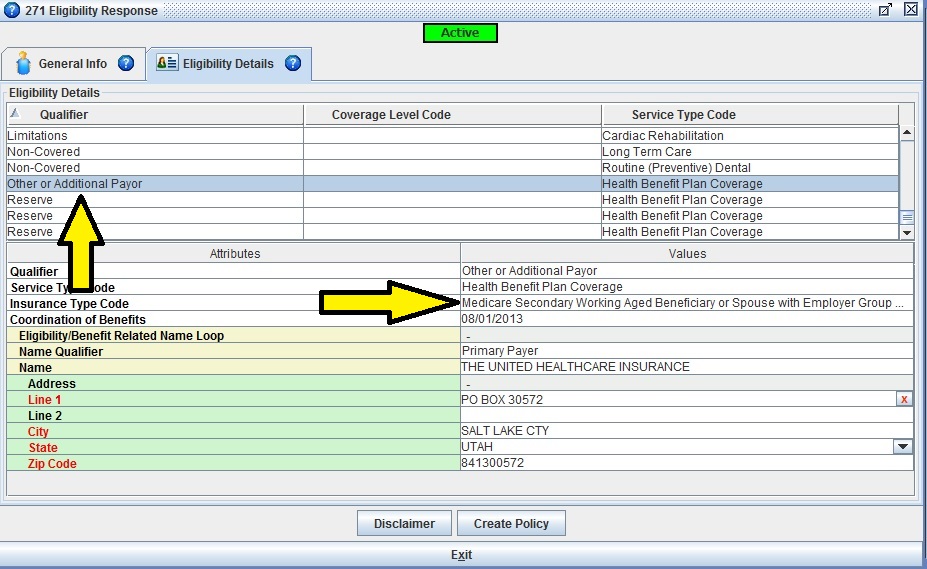

I have a faster and more accurate way: a real-time eligibility inquiry via Iridium Suite Practice Management Software. As indicated in the picture below, the Insurance Type Code is plainly indicated as Working aged beneficiary or souse with employer group health plan. Billing staff will be able to easily obtain accurate information to prevent claim rejections from occurring.

Contact sales@iridiumsuite.com today for more information or set up a free demo.